Navigating the Buying/Selling Process

May I predict the future ?

THE DIFFERENCE BETWEEN HOME WARRANTY & HOME INSURANCE

When purchasing a new home, it’s important to do in-depth research on all facets of the homebuying process. One thing you’ll need to understand is how to best protect yourself and your investment if anything were to go wrong. Check out the information on home insurance versus home warranty below to educate yourself on your options.

Home Insurance

Homeowners insurance pays for any accidental damages and loss that are caused by fire, lightning strikes, windstorms, and hail, however, damage from earthquakes and floods is typically not covered. It also covers the replacement of personal property in case of theft or damage and liability if a person were to get injured in your home or on your property. According to American Home Shield, the average annual cost of a homeowner’s insurance policy ranges between $300 and $1,000, and the bank usually asks you to obtain a policy before the mortgage is issued. Make sure to keep in mind that each type of coverage in the policy is subject to a limit and, in most cases, you will have to pay a deductible.

Home Warranty

A home warranty is designed to cover the cost of repairs and replacements of larger appliances and crucial systems in your home that may fail or break due to age and wear and tear. This includes but isn’t limited to HVAC, electrical, or plumbing components, kitchen appliances, and your washer and dryer. With a home warranty, you are required to pay premiums year-round, even if you do not use it, and it won’t cover damages if appliances were not maintained properly or if the damage is from a fire or other disaster.

YOUR GUIDE TO HOME APPRAISAL

You’ve found your dream home and now it’s time to cross all your T’s and dot all your I’s before it’s all your own. And one of the first items on your closing checklist the home appraisal. So, what exactly is that?

The home appraisal is essentially a value assessment of the home and property. It is conducted by a certified third party and is used to determine whether the home is priced appropriately.

During a home appraisal, be absolutely sure that the right appraiser conducts a complete visual inspection of the interior and exterior of the home. He or she factors in a variety of things, including the home’s floor plan functionality, condition, location, school district, fixtures, lot size, and more. An upward adjustment is generally made if the home has a deck, a view, or a large yard. The appraiser will also compare the home to several similar homes that were sold within the last six months in the area.

The final report must include a street map showing the property and the ones’ compared, photographs of the interior and exterior, an explanation on how the square footage was calculated, market sales data, public land records, and more.

After it is complete, the lender uses the information found to ensure that the property is worth the amount they are investing. This is a safe-guard for the lender as the home acts as collateral for the mortgage. If the buyer defaults on the mortgage and goes into foreclosure, the lender generally sells the home to recover the money borrowed.

</

SECRETS FOR A STRESS-FREE PURCHASE

LAY THE GROUNDWORK

LAY THE GROUNDWORK

Collect financial docs, such as bank statements, tax returns, pay stubs, etc. and avoid big purchases until you’ve met with a mortgage professional. Adding to your monthly payments can affect your ability to get a loan. If you can, start saving as early as possible to ensure you have adequate funds for a down payment and moving expenses.

WORK WITH AN AGENT

In almost all circumstances, the seller pays the real estate commission for both their own agent and the buyer’s agent. This means you get to reap the benefits of working with an agent for no out-of-pocket expense. Whether it’s finding the best mortgage broker or helping you negotiate through a multiple offer situation, your agent will be there to help you succeed.

COMMUNICATE EFFECTIVELY

Ask questions. If something in your contract seems confusing, ask about it before you sign. You don’t want to have questions after you’ve committed. Pick a communication method since there will be a lot of back and forth between you and the team. Finally, be direct with your team and don’t hesitate to speak up if you don’t like something.

BE PATIENT & DECISIVE

Buying a home is an important decision. You have to balance patience with your ability to be decisive when you find the right home. Depending on market conditions, your first offer may not get accepted but be persistent. Trust your intuition when you’ve found the right house and go for it!

BE FLEXIBLE

Remember, you can always update your home, the neighborhood may change in a few years, or you may decide to move again, so this might not be your final home. Besides your financial capabilities, almost everything else is beyond your control so be flexible with the process.

Please feel free

CONTACT ME FOR MORE INFORMATION ABOUT HOME BUYING!

Your REALTOR for life OLENA JOHNS

Blue Tape Day or New Construction pre Walkthrough

Today my buyers got a

Blue Tape Day✨

Or New Construction pre Walkthrough

It’s why buyers need a own realtor and not just builder representative because

Together with your Realtor as your representative , you can inspect the house and mark off any items that need attention

That’s where the blue tape comes in.

All the tagged parts of the home create a “punch-list,” or “punch-out list,” for the builder to correct.

Also we used red tape as red flags that require repair.

I will list what to looking for /by https://www.rocketmortgage.com/learn/a-complete-final-walkthrough-checklist /

- Uneven floors

- Completely broken or severely damaged appliances

- Completely broken or severely damaged home systems

- Poor ventilation

- Leaking roof

- Cracks in the foundation

- Other threats to the structural integrity, like rotten wood

- Poor drainage

Some possible risks to your new home’s interior and exterior include:

- Signs of pests, like rodents, termites, ants, and larger animals such as raccoons

- Mold growth in moist areas, like the bathroom and kitchen

- Improperly installed structures like handrails, flooring or lighting

- Faulty wiring

- Clogged gutters

- Early water damage

- Cracks in the foundation (allowing water and radon to seep in)

- Other environmental hazards such as carbon monoxide

Also need to inspect every surface, from floors to mirrors to walls.

At that time, it’s important to check the windows as well.

- Glass is clean and easy to see through, with no scratches or cracks

Windows are more than an aesthetic accessory. They also play a key role in protecting your home.

Like windows, drawers and doors need to move smoothly.

This includes any type of door or drawer, like front doors, back doors, interior doors, garage doors, storm doors and cabinets.

Examine your front door in particular. It’s a focal point and adds curb appeal, which can help with prospective buyers in the future.

Also many buyers may not realize how many systems and appliances there are in a home.

But each one needs to be examined during the blue tape walkthrough.

You also may to inspect home systems like:

- Air conditioning

- Heating

- Plumbing

- Electricity

Fortunately, we found only some scratches and a few electrical outlets that didn’t work so looking forward to final walkthrough

#olenajohns #yourrealtorforlife #newhome #newconstructions #buyerspecialist #buyeragent #internationalrealtor #movetoflorida #internationalrealtor #pensacolarealtor

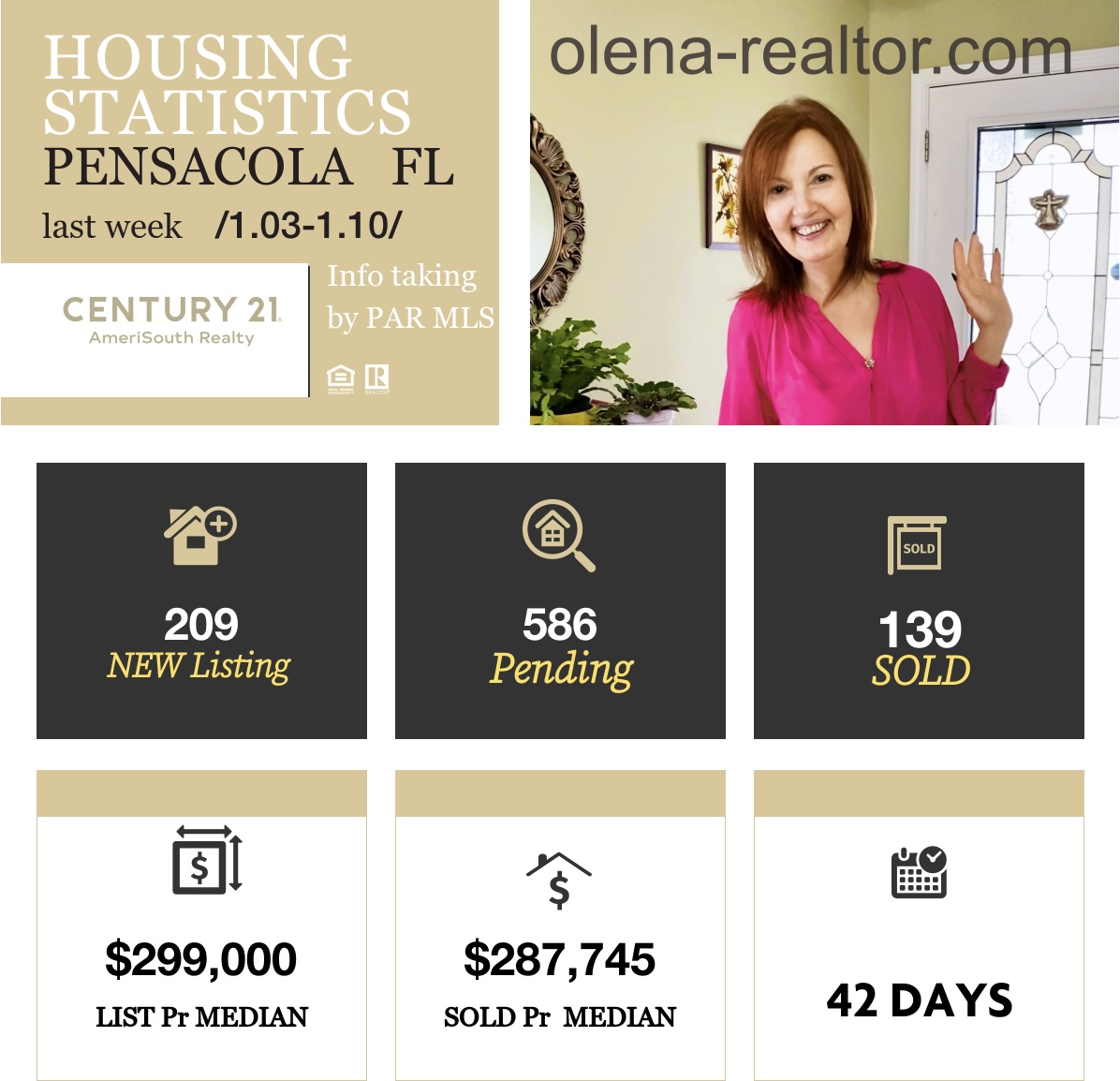

HOUSING STATISTICS / PENSACOLA , FL

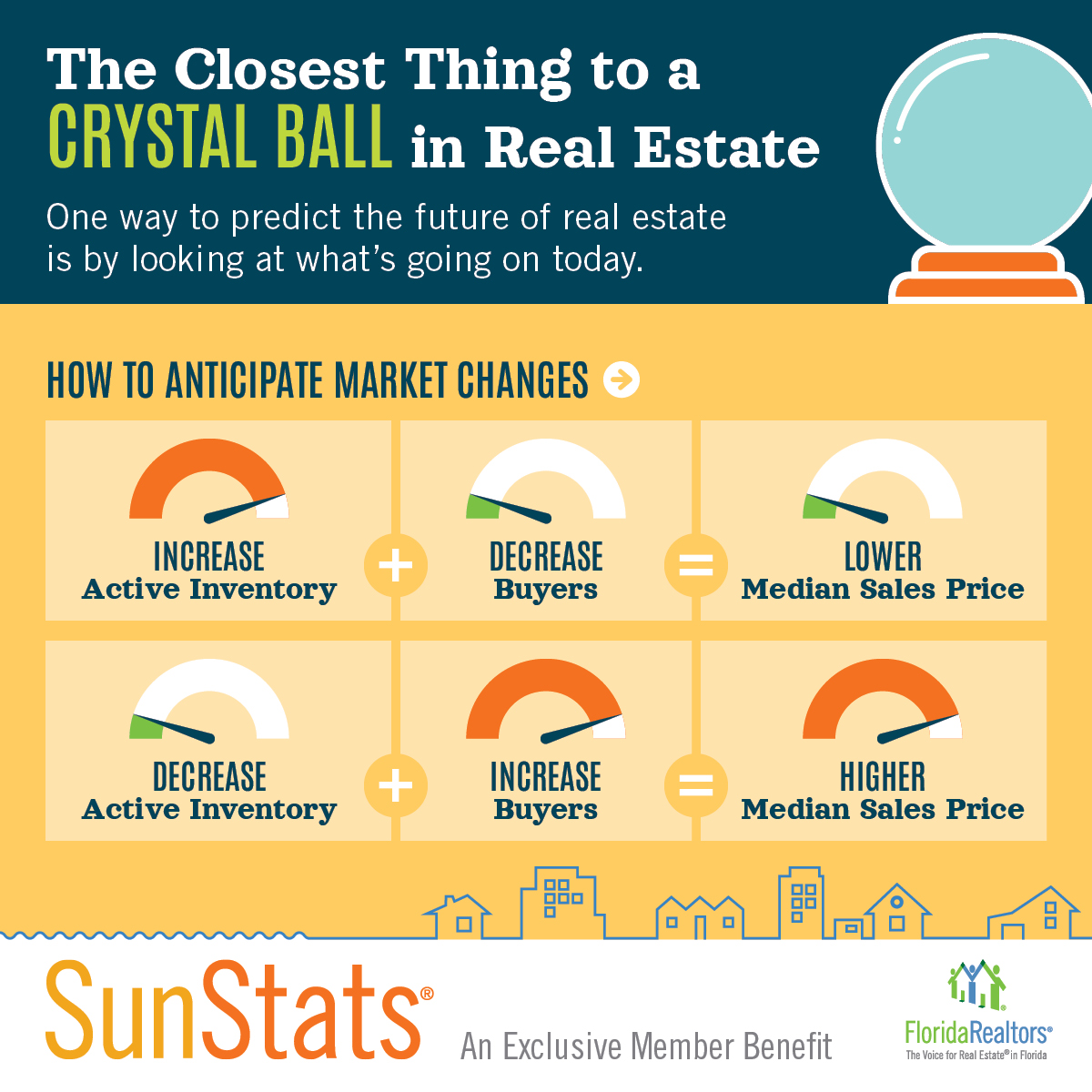

With today’s high home prices and increasing interest rates, a significant number of buyers are close to being priced

out of the market. With declining prices and increasing inventory, buyers now have choices. With multiple offers a thing

of the past, in most cases, buyers will not pay more for a home than they should.

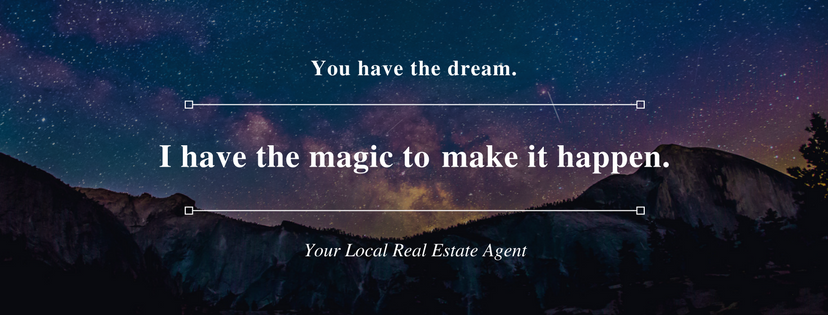

By Carl Medford “Home prices are very similar to the prices of stocks on the stock market: they fluctuate up and down as market

conditions change. The only price that matters for any given stock is the amount an investor is willing to pay on the day

you choose to sell, regardless of what you paid to purchase it or how high or low it has been in the past. Until a stock is

sold, it only has a ‘paper value’ which is meaningless until there is an actual sale. It is exactly the same in real estate:

homes around you may have sold for much higher prices a few months ago, but in the current market conditions, no one

is paying those prices anymore. Buyers are only willing to pay ‘today’ prices, not ‘yesterday’ prices. The bottom line in this new market is simple: While it was awesome to watch values soar in the previous overheated market, in the new reality, some of those gains will need to be given back to get a sale.”

And, if you really think about it, since the true value is only there the day you close escrow, sellers who refuse to set realistic list prices are suffering from a classic case of take wishful thinking.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link