- How will the property be used? Vacation home? Investment opportunity? Primary residence while you study or work?

- Do you have an appropriate U.S. issued visa?

- Have you bought or sold property before in the United States? Are you familiar with the process?

- How will you pay for the property? Are you going to apply for a U.S. mortgage? Where are your funds located? Do you have an ITIN number?

- Have you consulted with a lawyer and/or tax consultant?

What is a CIPS?

A Certified International Property Specialist (CIPS) is a global real estate professional who has undergone specialized training to complete international transactions seamlessly and with reduced risk. The CIPS designation is the only international designation recognized by the National Association of REALTORS®.

Only REALTORS® who have completed extensive coursework and demonstrated considerable experience in international business are awarded this prestigious designation.

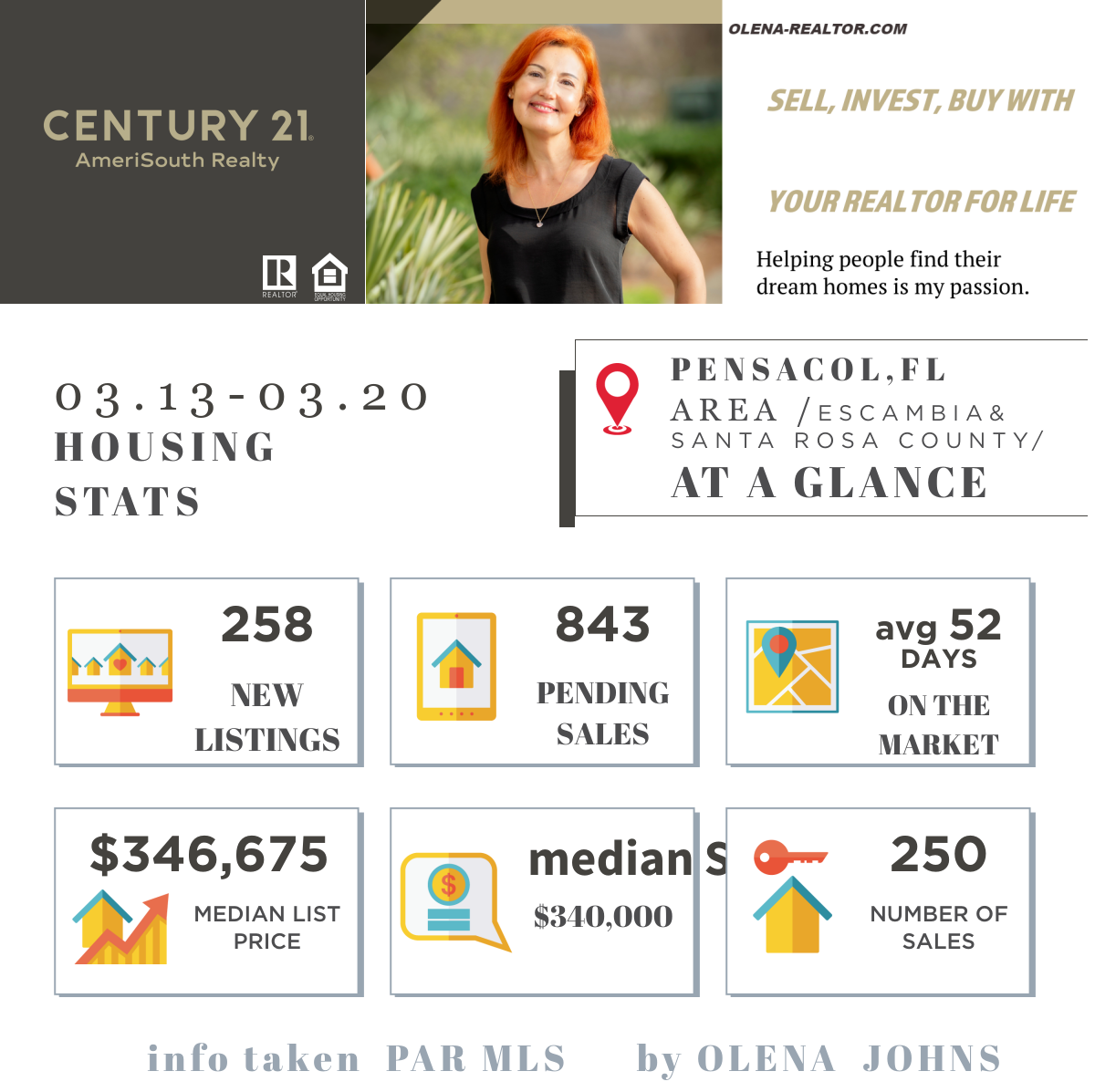

Value Proposition

As a Certified International Property Specialist,

I have the training, resources and experience to help you purchase property in the United States. I have worked with buyers from locations around the world, and I can help you understand the process. With access to the CIPS global network and REALTOR® technology, I can help you find and purchase the property that is right for you.

My goal is to streamline and simplify the process of buying real estate in the United States. My services can save you time and money. Just give me a call !

Olena Johns +18503809539

#InternationalRealtor #Floridarealtor

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link